north carolina estate tax return

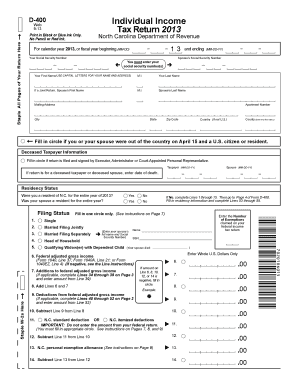

An estate or trust that is granted an automatic extension to file a federal income tax return will be granted an automatic extension to file the corresponding North Carolina income tax return. Form D-407 is a North Carolina Corporate Income Tax form.

How Do You Know If A Will Is Authentic And Valid Carolina Family Estate Planning

The portion that is deductible on the tax return is that property tax portion that is based on the value of the vehicle and is paid to the county.

. Download or print the 2021 North Carolina Application for Extension for Filing Partnership Estate or Trust Tax Return 2021 and other income tax forms from the North Carolina Department of Revenue. North Carolina property tax rates range from a low of 042 percent in Watauga County to a high of 122 percent in Durham County. Collected from the entire web and summarized to include only the most important parts of it.

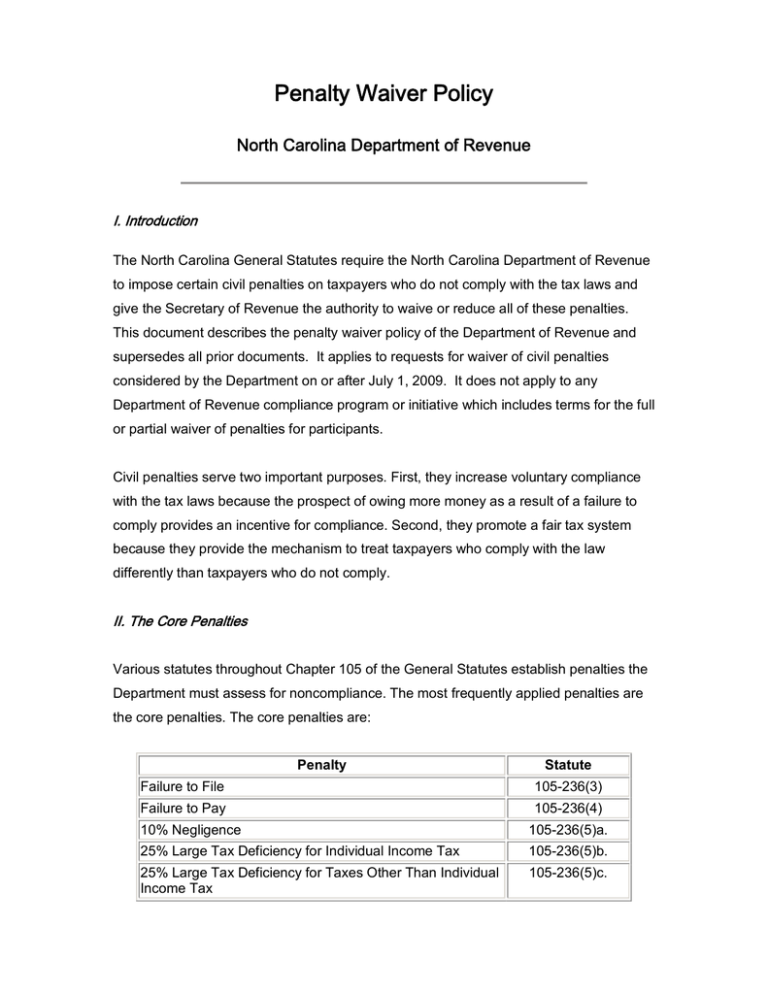

Previous to 2013 if a North Carolina resident died with a large estate it might have owed both federal estate tax and a separate North Carolina estate tax. Another way in which the transfer of wealth can be taxed is through the collection of an inheritance tax Unlike gift and estate taxes which are paid by the estate before the transfer of an asset an inheritance tax is paid by the recipient of the gift after the. The states governor appoints the secretary of revenue who heads the department.

IRS Form 1041 US. Does North Carolina Have an Inheritance or Estate Tax. The information included on this website is to be used only as a guide in the preparation of a North Carolina individual income tax return.

North Carolina Estate Tax. Recently we wrote about North Carolina potentially joining several other states that are repealing state estate tax or death tax. Can be used as content for research and analysis.

North Carolina does not collect an inheritance tax or an estate tax. However state residents should remember to take into account the federal estate tax if their estate or the estate. North Carolina Individual Income Tax Provisions Once a state decides to individually tax residents on their income they must determine which filing system to use.

The decedent and their estate are separate taxable entities. Income Tax Return for Estates and Trusts is required if the estate generates more than 600 in annual gross income. 105-1535a2 allows a taxpayer in calculating North Carolina taxable income to deduct from adjusted gross income either the North Carolina standard deduction amount or the North Carolina itemized deduction amount.

Effective January 1 2013 the North Carolina legislature repealed the states estate tax. Estates and Trusts Fiduciary. Then print and file the form.

Link is external 2021. Application for Extension for Filing Estate or Trust Tax Return. North Carolina chooses a joint system which adds the incomes of both spouses in a married couple together and taxes it as a single amount.

6 Things Every Homeowner Should Know About Property Taxes. NC K-1 Supplemental Schedule. The departments general information number is 1-877-252-3052.

Complete this version using your computer to enter the required information. More on Money. Before filing Form 1041 you will need to obtain a tax ID number for the estate.

North Carolina doesnt charge an estate tax or an inheritance tax at the state level. Before we get into the nitty-gritty of gift taxes lets define what a gift actually is in the eyes of the IRSA gift is basically anything of value that you transfer to another individual or entity without expecting anything of. The North Carolina General Assembly approved eliminating the states tax on military pension income in the fiscal budget that was.

Last week the North Carolina House Finance Committee approved repeal of the states death tax. What about Paying a North Carolina Inheritance Tax on My Inheritance. Owner or Beneficiarys Share of NC.

North Carolina Gift Tax History. Department of Revenue Offers Relief in Response to COVID-19 Outbreak Notice. The North Carolina Department of Revenue administers tax laws and collects taxes in the state of North Carolina.

If the return cannot be filed by the due date the fiduciary may apply for an automatic six-month extension of time to file the return. North Carolina Unauthorized Substances Tax According to North Carolina law anyone who possesses an unauthorized substance including marijuana cocaine moonshine mash and illicit mixed beverages will have the substances confiscated and must then pay an excise tax within 48 hours. PDF 33221 KB - January 04 2021.

Can a taxpayer deduct more than 10000 of real estate tax on a North Carolina return. Like the Federal Form 1040 states each provide a core tax return form on which most high-level income and tax calculations are performed. Theres also a number for inquiries into individual tax refunds.

Impact of Session Law 2022-06 on North Carolina Individual and Corporate Income Tax Returns COVID-19 Updates. An estates tax ID number is called an employer identification. North Carolina Estate and Inheritance Taxes.

North Carolina currently does not enforce an estate tax often referred to as the death tax But the federal government levies the estate. Application for Extension D-410P for Filing Partnership Estate or Trust Tax Return Web 8-19 Instructions Purpose - Use Form D-410P to ask for 6 more months to file the North Carolina Partnership Income Tax Return Form D-403 or the North Carolina Estates and Trusts Income Tax Return Form D-407. Beneficiarys Share of North Carolina Income Adjustments and Credits.

North Carolina repealed its estate tax in 2013. The state exemption amount was tied to the federal one which means that for deaths in 2012 estates with a total. Since 2013 North Carolina has combined the annual property tax payment to the county in which you live with the annual vehicle registration fee that goes to the state.

While some taxpayers with simple returns can complete their entire tax return on this single form in most cases various other additional schedules.

North Carolina Estate Tax Everything You Need To Know Smartasset

North Carolina Estate Tax Everything You Need To Know Smartasset

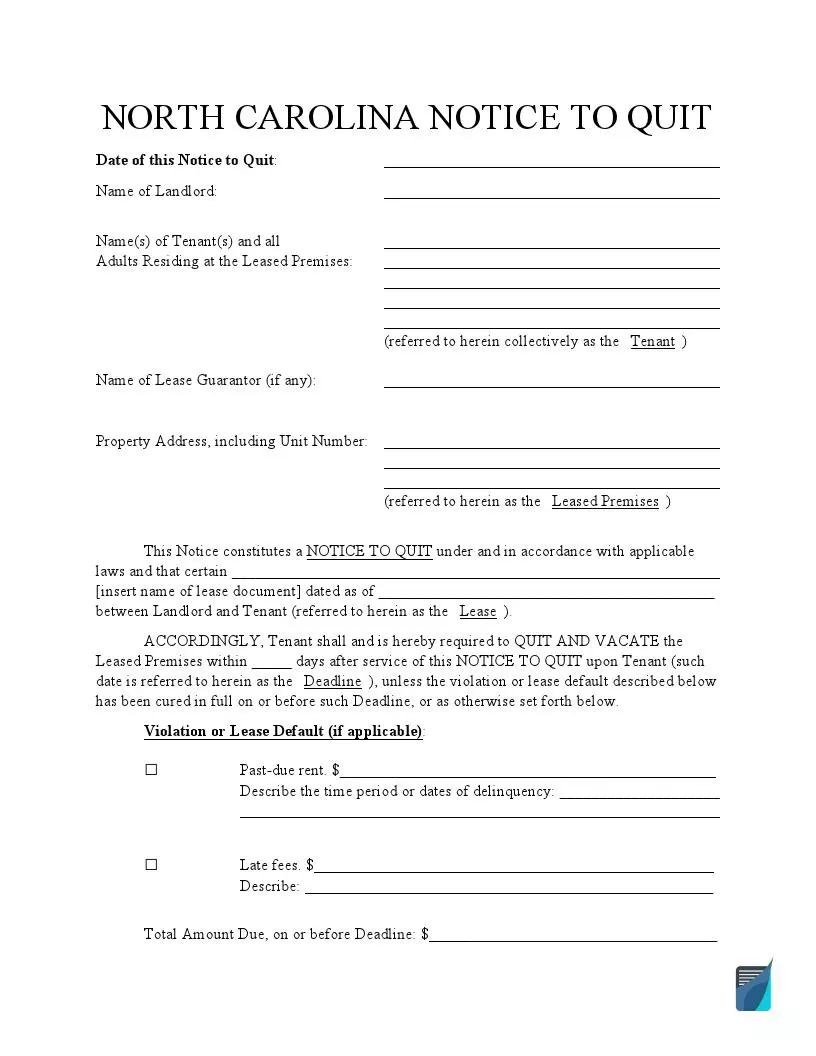

Free North Carolina Eviction Notice Forms Nc Notice To Quit Formspal

North Carolina Gift Tax All You Need To Know Smartasset

Nc Tax Forms Pdf Fill Online Printable Fillable Blank Pdffiller

![]()

Estate Tax What Is The Current Estate Tax Exemption Carolina Family Estate Planning

What Happens If You Die Without A Will In North Carolina Bell Davis Pitt

North Carolina State Taxes 2022 Tax Season Forbes Advisor

Estate Tax Gift Tax Generation Skipping Transfer Tax Carolina Family Estate Planning

North Carolina Gift Tax All You Need To Know Smartasset

How Do State Estate And Inheritance Taxes Work Tax Policy Center

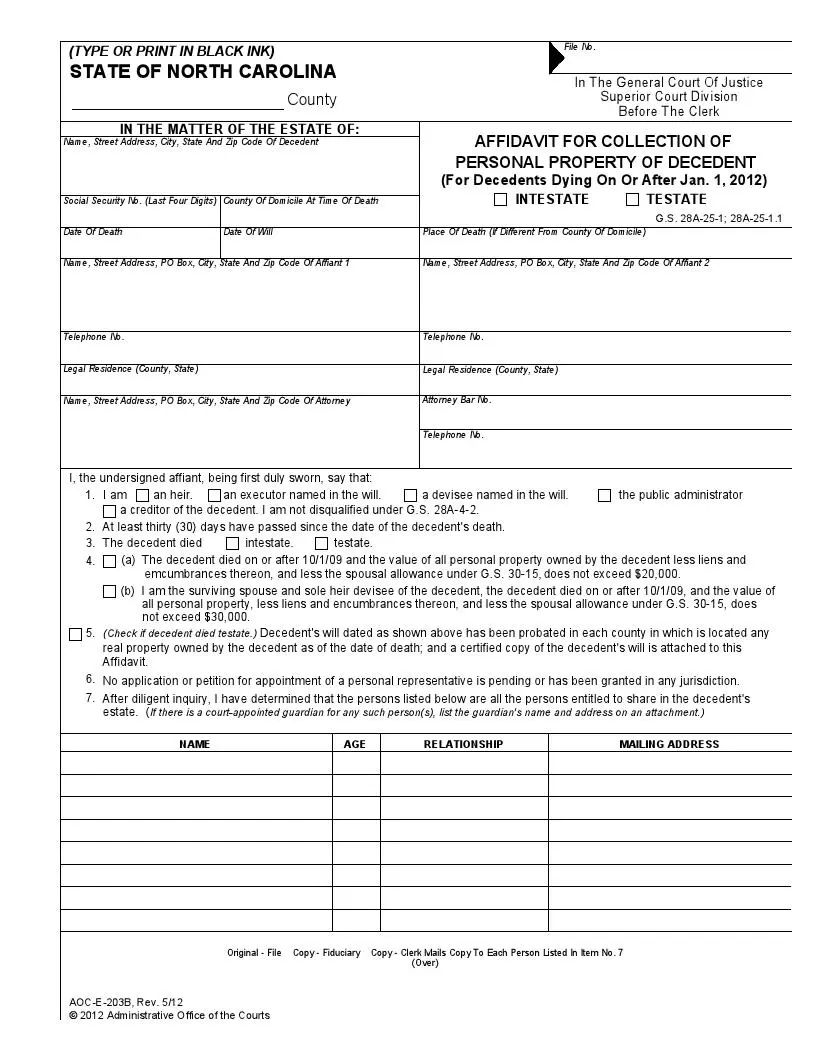

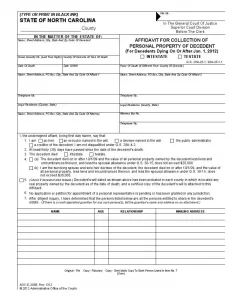

Free North Carolina Small Estate Affidavit Form Pdf Formspal

Free North Carolina Small Estate Affidavit Form Pdf Formspal

North Carolina Estate Tax Everything You Need To Know Smartasset

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

Penalty Waiver Policy North Carolina Department Of Revenue

What Is A Charitable Remainder Trust Carolina Family Estate Planning